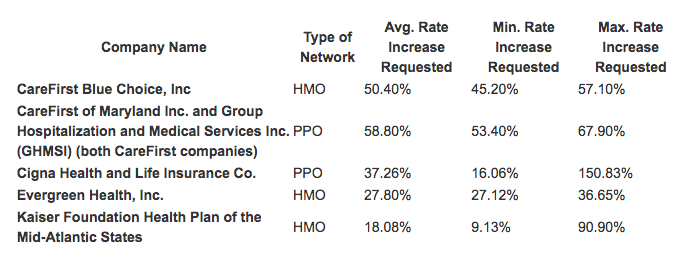

WASHINGTON — Health insurance companies have submitted average rate increase requests for the individual plan markets for 2018 to the Maryland Insurance Administration that range from 18 percent to nearly 59 percent.

The insurance administration will issue decisions about 2018 rates in late summer, after reviews and public input.

The largest rate increase request is for the CareFirst of Maryland Inc. and Group Hospitalization and Medical Services Inc. PPO (both CareFirst companies), seeking an average increase of 58.8 percent, or a monthly premium average before any subsidies of $715.

The smallest rate increase request comes from Kaiser Foundation Health Plan of the Mid-Atlantic HMO, seeking an average increase of 18.08 percent, or $359 a month before subsidies.

“It is important to remember that these rates are what companies have requested, and not necessarily what will be approved,” said Insurance Commissioner Al Redmer Jr. “There will be a thorough review of all the filings. As in years past, we may require changes.”

Before any approvals, the administration reviews all of the carriers’ statistics and assumptions, and considers public comments as part of the review process. By law, rate requests it determines are excessive in relationship to the benefits offered, or are unfairly discriminatory, are not approved.

Here are the carriers’ proposed rate changes in the individual market in Maryland:

Consumers can review filings and submit comments.