WASHINGTON — Buying a house or a condo comes with a few last-minute expenses, and closing costs in Washington run higher than the national average.

Most buyers either don’t know it or don’t bother to do it, but you can shop around for the best closing costs. And it’s easier to do now.

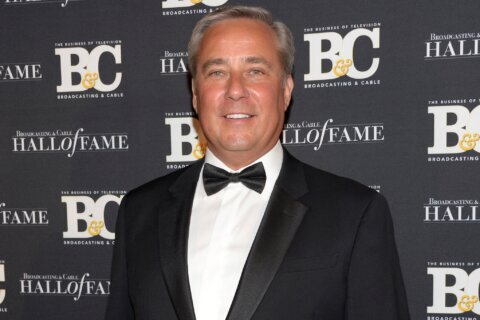

“For 40 years we had a document called the Good Faith Estimate, and that had to be kind of accurate, but there was a lot of wiggle room,” Holden Lewis, Bankrate.com’s senior mortgage analyst told WTOP.

Regulations from the Consumer Financial Protection Bureau mean lenders now have to include all costs up front.

“Buyers should know that they can compare closing costs, because that information is right there on the loan estimate if they read it,” Lewis said.

“The loan estimate tells them which things can vary and which things can’t. If you apply for a mortgage at two different places, one might cost hundreds of dollars more than the other for essentially the same loan.”

The District has the 14th-highest closing costs in the nation — an average of $2,213 on a $200,000 loan.

Hawaii has the highest average closing costs in the country. Pennsylvania has the lowest.