EDITOR’S NOTE: The housing bubble before the recession drove prices up at the Delmarva beaches. Then prices sank. It’s been nine years since the end of the recession. So have the beach communities recovered? In the series, Beach Real Estate Guide, WTOP’s Colleen Kelleher brings you advice on buying, selling and renting at the Delaware and Maryland beaches.

DELMARVA — When houses and condominiums come on the market around the D.C. metro area, they sell quickly, often in under a month. But that’s not necessarily the case with vacation homes at the Delaware and Maryland beaches.

Sellers at the beach face challenges those around D.C. do not. And they often have to wait months for their homes to sell.

Why? There are fewer buyers for beach properties. Vacation-home sales account for fewer than one-fifth of homes sales annually, according to the National Association of Realtors.

Beach buyers, if they are financing, typically have to have more money to put down on a purchase than they do on their primary homes.

And at the beach, the selling season is limited because often the properties in places like Ocean City, Maryland, are rented during the summer to vacationers.

“Essentially, during the summer, a lot of properties are rented and the agents can’t show them or can only show them from noon to 2 p.m. on Saturdays,” said Long & Foster real estate agent Steve Mastbrook, who adds that the peak months for selling at the beach are April, May and September.

Because a number of WTOP readers and listeners have second homes at the beach, WTOP talked with real estate professionals in both states to get tips to help those who may be thinking about selling.

1. PRICE YOUR BEACH HOME PROPERLY

In any real estate market, price and appearance matter. In a beach town, those factors can mean the difference on whether a property sells quickly or lingers for months.

Mastbrook, who sells in Ocean City and lower Delaware, said two things keep beach properties from selling. Either they are overpriced or they have not been updated.

“Everybody wants move-in ready, even when they tell you that it’s not important. It is important,” said real estate agent Allison Stine of The Allison Stine Team at Long & Foster in Bethany Beach, Delaware.

“If your house isn’t perfectly priced and doesn’t look great, it is not going to sell because the bottom line is people are still buying your house through pictures that they see on the internet. And it has to be an attractive home,” said Stine who sells in Fenwick, Bethany, Rehoboth and other Delaware communities.

Ninety-three percent of buyers start their beach property searches online, said Joe Wilson, a real estate agent with Condominium Realty, Ltd. in Ocean City.

“If there’s one single thing that I was going to tell someone to do, getting a professional photographer to come in and take pictures of their place would be it,” said Wilson, a board member on the Coastal Association of Realtors.

2. LISTEN TO PROFESSIONAL ADVICE

Real estate agents critically assess a seller’s beach property before it goes on the market. They look at the house or condo differently because they are not emotionally invested in it, like an owner is.

“People say, ‘I know the last one sold for X but mine, it’s so special. Mine is worth so much more.’ You know, unless your windows are trimmed in gold, the market is going to speak to you about what the value of your property is. And if the market isn’t speaking to you, the appraisers will,” Stine said.

“I can walk into a house and see right away if something needs to be changed. I’m sensitive to the fact that I’m talking about somebody’s decorating style,” Stine said.

Like Stine, Grace Masten assesses what a seller needs to do to get top dollar.

“Your realtor is coming in, first time, a fresh set of eyes. Don’t be taken back by comments,” the broker-owner of Sea Grace at North Beach, Realtors, in Ocean City cautions sellers. “Listen to your realtor. Trust your realtor. Don’t take offense.”

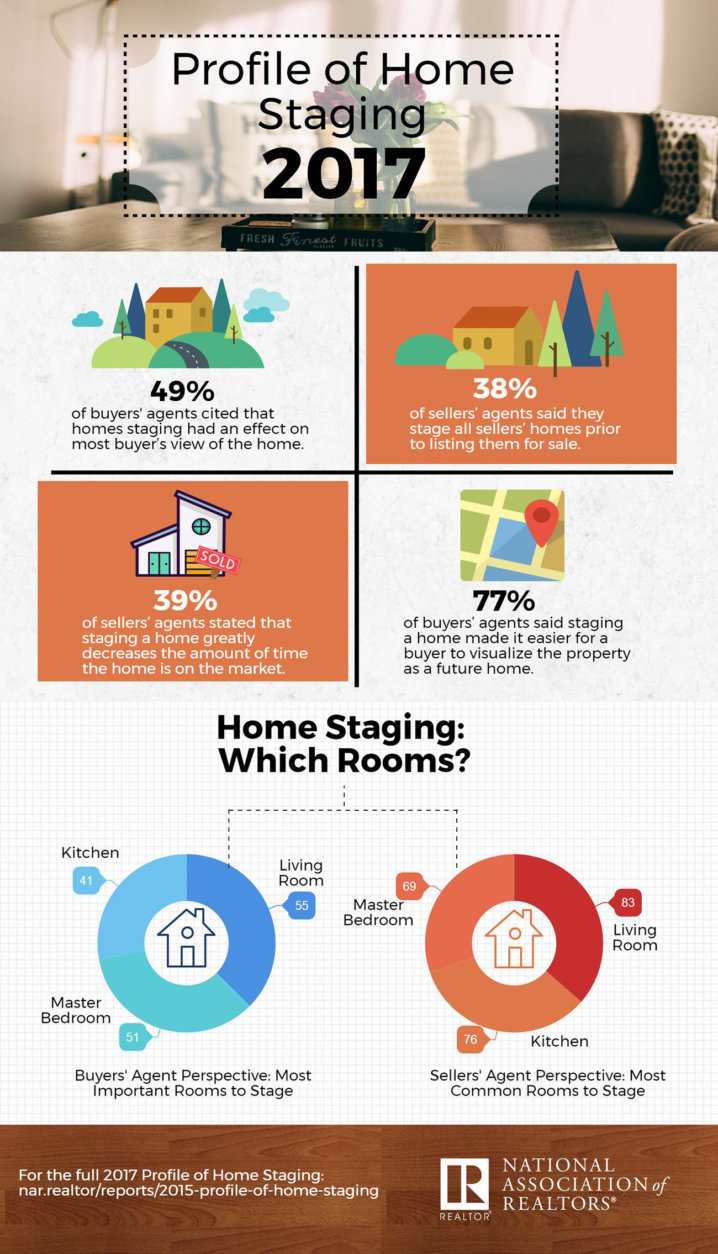

3. STAGE YOUR BEACH PROPERTY TO SELL

What buyers see matters, especially since most properties in the Delmarva resort towns are sold furnished. Those buyers will remember worn out sofas from the 1980s and broken wicker chairs.

“Buyers always say, ‘Well, I can look past this. I can look past this. I can look past clutter.’ They don’t. They just don’t,” Stine said.

All of the homes Stine sells are professionally staged.

“You have to meet with a stager, whether they purchase anything for your house or just rearrange it, put things away, do some editing. You have to meet with a stager because the house has to look perfect. It has to,” Stine said.

A stager will highlight a home’s assets and minimize its flaws. Stine leaves the tough talk about making changes to the stager.

“I think people are more accepting of it when it comes from a stager. And thanks to HGTV, people are familiar with this term. Right? They know what this person does for a living. They’ve seen it in action. They watch it on TV.”

With older homes, the exterior also needs to be attractive, Stine said.

“Make sure that the first impression of the home is a good one,” she said.

4. INVEST IN COSMETIC UPGRADES

Bad carpets? Replace them. Dated countertops? Replace them. Aging heating and air conditioning systems? Replace them.

Nobody wants “old and nasty,” Masten said. With furniture, nobody wants the hassle of moving it, so hire someone to haul it away.

“When you are competing in a market like this, yes, put new furnishings in,” said Masten, adding that one of the best kept secrets is Dennis Thrift Shop in Bishopville, Maryland. “You can order new or walk in and pick up dining room furniture, dressers, new beds. And they deliver.”

If new furniture is not an option, Wilson suggests owners invest in slipcovers, throw pillows and a coat of paint.

“Even a small, fake plant will add some life to the room,” Wilson said.

But don’t sell the property empty. It’s hard for buyers to visualize how the rooms will look when the furniture is gone.

Consider renovating kitchens and bathrooms. Without upgrades, agents say a property may sit on the market longer.

In general, younger sellers tend to be more likely to update properties, Mastbrook said, because they understand the ramifications of not doing so.

“Older folks are not used to updating,” Mastbrook said, adding that those sellers may be more willing to take a price cut just to get the property sold.

“If you can afford to update them within a period of time before you put it on the market, I think it’s going to make your unit sell a lot faster and you’ll probably get more dollars for your unit if you do these upgrades, Mastbrook said.

“If they don’t have the upgrades, people are going to move on to the next one.”

5. GET A HOME INSPECTION AND MAKE REPAIRS

Don’t wait for the buyer to get a home inspection. Get one before listing your beach property.

Stine, who sold her Bethany home and moved to Rehoboth last year, did just that.

“I wanted to know what a buyer was going to find because things weren’t obvious to me. But you do find things in a crawl space or things in an attic or electrical outlets that aren’t working,” Stine said.

Why make repairs? Buyers will overvalue the cost of those repairs.

“We have buyers who will walk into a house and say, ‘Wow. This whole house needs to be painted. Well, that’s $12,000 or that’s $15,000 or the carpets need to be replaced. That’s $10,000. They roll off these numbers that are so high and not accurate. Wildly inaccurate, as a matter of fact. So if you are a seller, and you are preparing your home, especially an older home, you have to understand what you are competing against,” Stine said.

Buyers will do one of two things, if repairs need to be made, she said.

“They’re going to add up these numbers, these wildly inaccurate figures for making your home perfect.

“They’re either going to deduct them from the offer that they make you, or they’re going to determine that they’re just too much. Somebody just doesn’t want to take it on at all. They’ll rather go down the street and buy something brand new, that’s move-in ready,” Stine said.

- 7 tips for buying beach real estate in Del., Md.

- Selling beach property? 8 ways to get the best price

- Tips for beach rentals through VRBO, Airbnb

- What’s the best beach for the money?

6. KNOW THE COMPETITION — NEW HOMES

Older beach homes are not only competing against each other for buyers, they’re competing against new developments.

New home developments are popping up across Delaware’s Sussex County and in the communities outside of Maryland’s Ocean City, increasing the number of options buyers have.

From fiscal year 2014 through March 2018, Sussex County, where the beaches are located, granted permits for 10,009 dwellings and 1,380 manufactured homes, according to figures from the county administrator’s office.

“We know that if you’re in a neighborhood next to a new homes development, your value might be a little bit lower,” said Masten, who also sits on the board of directors of the Coastal Association of Realtors.

New construction impacts a home that is a resale, especially in communities being developed over a long period of time.

“If you are trying to compete with a developer, that’s very difficult to do as a seller because a developer can give financial incentives. They can give free sunrooms and free breakfast bars and free lot premiums. They can do things that will make their sale more attractive,” Stine said.

Plus, people like buying new homes.

“They like the idea of being able to make their own selections, picking their own tile, picking their own countertops, even if they’re not getting a full custom-built home,” Stine said.

7. BE AWARE OF THE TAX TRIP-UP

People who own property in Delaware but live elsewhere may want to talk to their accountants or financial advisers before selling, especially if they will have capital gains.

“The state of Delaware is tired of not getting their capital gains taxes paid,” Stine said. “If you are a non-resident seller, you kind of go back home to New Jersey or Pennsylvania or Florida or wherever you go, and you sort of forget about the little tiny state of Delaware, and you don’t necessarily file a tax return. So one of the things we’re seeing with sellers is that the state is offering sellers the option to withhold any taxes or capitals gains due at the settlement table and that seems to be alarming some of our sellers.They’re not expecting that.”

Stine said real estate agents will tell sellers to wait until they have enough information to determine how much they may owe to Delaware, to talk with their tax advisers and to make sure they file returns with Delaware, if any money is owed.

8. EVALUATE WHETHER TO TAKE A LOSS OR HOLD ON

Owners who bought beach getaways during the peak of the housing boom or during the run up to it from 2005 to 2007 are the ones selling, Stine said.

Most likely, their properties are not worth what they paid.

“They are probably upside down,” Stine said.

Some of those sellers put large deposits down to buy and then didn’t see values rise. Now, as they go to sell, they may need to pay for home improvements, landscaping and repairs to get top dollar for their homes. Plus, they will have to pay a real estate commission to sell them.

“They’re not happy about it. They’re losing some money. … Even if they are breaking even on their sales prices, they spent money to get into it. They spent money to get out of it,” Stine said.

During the beach real estate boom, a pack mentality existed. People had to be part of the pack and own a second home, real estate agents said.

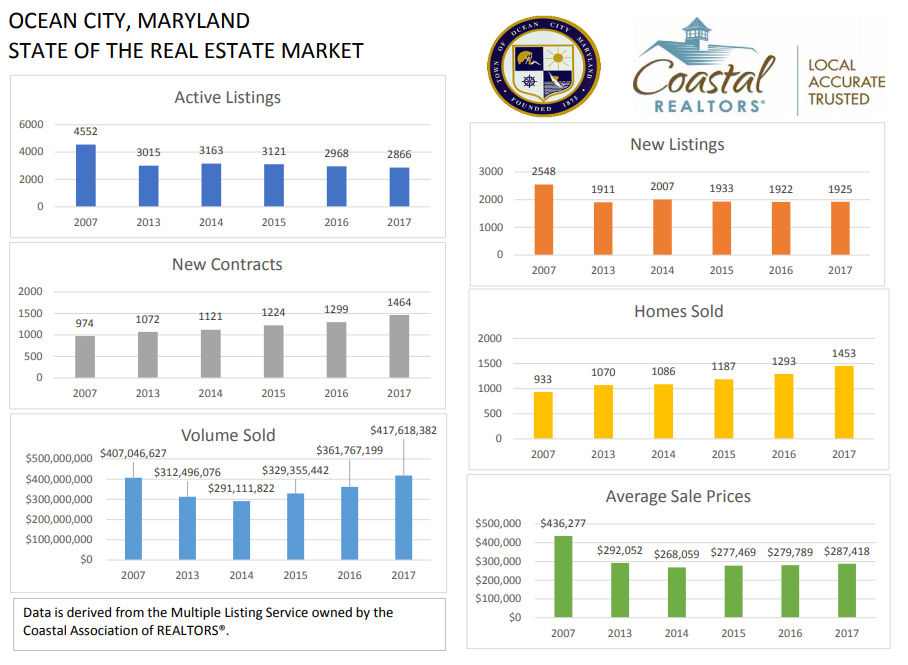

“That was exactly what was happening back then. There were properties that were selling $800,000 oceanfront and they’re in the $400,000s now. I don’t see any time soon that those properties will be back into the $800,000s,” Masten said.

“I don’t think the prices are going up as fast as some people might want, you know how it was in the 2006, 2007, 2008 era. But it’s certainly improving now,” Wilson said.

Wilson said it can be a tough decision for an owner who bought when prices were high to decide to sell.

“You can show them what the market is doing. You can do everything you can do to command a high value for them, but at the end of the day, there’s only so much the market is going to allow for.”

He said owners need to decide “whether they want to keep the place for a couple more years and see if the values continue to recover, or if they’re just ready to get out and potentially take a loss.”

Many of those owners, including Mastbrook, will continue to wait.

The former Silver Spring, Maryland resident vividly remembers the day when his wife Christine saw that she could just walk right out to the beach from a little oceanfront efficiency in Ocean City.

She turned to him excitedly and said, “Get it. Get it. Get it.”

He did, paying top dollar.

“I bought a very expensive condo in Ocean City in 2006, thinking the market was just going to continue to rise. However, my crystal ball broke and the market did tank. However, I’ve fully enjoyed the condo that I’ve had and I’m just going to hold on.”