WASHINGTON — If you have investment income or experience a windfall income year – maybe from selling a business — tax withholding can be tricky.

For the most part, the IRS and states want their tax money during the quarter in which the income is received. But there are certain safe harbor provisions that allow you to delay these payments until tax time the following year.

However, many mistakenly believe that holding onto the tax money until tax time is the best strategy. After all, why give money to the IRS or state until you absolutely must?

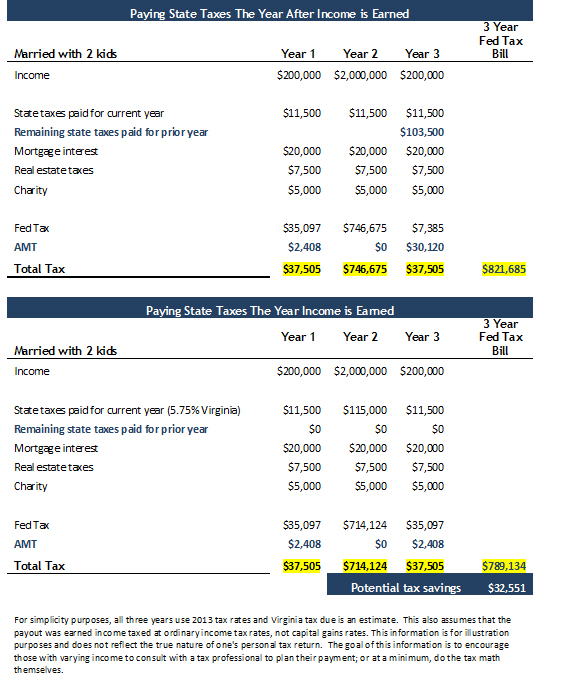

Fortunately, there’s a simple, but effective, strategy that may have a huge impact on the amount of state tax you will ultimately pay. I use an extreme example to make the point, but it can apply to smaller variations in annual income as well.

Example: This strategy only applies to a rare income event – not something that would be part of your normal paycheck. Let’s say for 2014, you earned $200,000. You also expect to earn $200,000 again in 2016. But in 2015, you experience a windfall income event and you make $2 million. Well, as exciting as all that income is, it also means you’re going to pay some serious tax on it.

When to pay state taxes

Virginia residents pay a state tax rate of 5.75 percent. Going back to the example above, a person in that situation would normally pay $11,500 to Virginia on an income of $200,000 (short of any deductions). But the year that person earns $2 million, he’ll owe $115,000 in state taxes. Ouch!

So if he paid $11,500 in state taxes for 2014, the state wants at least this figure in 2015 (through withholding or quarterly payments) to avoid penalty and interest next April. In this example, the remainder, approximately $103,500 will be due with the state tax filing in April 2016.

Value of paying state taxes in year income was earned

The question to ask is this: “When is the most value achieved from the state tax deduction?”

Even though a state may not require the funds until the following April, they are deducted from income in the year in which they are paid. So, if the check is written in December 2015, the deduction will be applied to the 2015 return. A check written in April 2016 will be applied to 2016.

Let’s look at an example of the two options – paying state tax in the year after it’s earned and paying it in the year it’s earned.

In the case above, the deduction will likely be more valuable in the windfall year for two reasons. First, you may find yourself in a higher tax bracket. It’s better to use the deduction while paying at the highest (39.6 percent) tax bracket.

Next, is the Alternative Minimum Tax (AMT). In the spirit of simplification, the tax code doesn’t allow someone to deduct most of his income with things such as taxes and mortgage interest. So, when filling out the IRS forms, tax payers have to calculate taxes two different ways.

The traditional way, which in the first example of paying taxes the year after income is earned, produces a federal tax bill of $7,385. However, the IRS says, “Nice try. We did your math our own way, and you owe another $30,120 for AMT.”

In the example given, the state tax deduction is more valuable, to the tune of over $32,000, in the year of the windfall.

Do your state-tax homework

To find out if it might make sense for you to prepay your state taxes, talk to a CPA or tax professional; they can walk you through the different scenarios. Also, ask them about reducing your withholding for the following year when your income returns to normal.

You may also want to discuss how you can bump up your charitable donations for the year – even giving next year’s amount this year – since those deductions are not part of the AMT.

Tax payers can use Turbo Tax, or the company’s app, Tax Caster, to do some calculations on your own to see what might happen, and how you might be able to save by paying ahead.

Again, it’s a good idea to think and plan ahead, especially in high-income years, to potentially lower your tax bill and eliminate any disappointing tax surprises.

Editor’s Note: Barry Glassman, CFP®, founder and president of Glassman Wealth Services in McLean, Va., is a nationally recognized leader in investment and wealth management. His fee-only firm offers successful professionals, executives and business owners financial guidance and resources to effectively manage their family’s wealth. Follow Barry on Twitter at @BarryGlassman.

Follow @WTOP and @WTOPliving on Twitter.