WASHINGTON — Saving for college is a top priority for many parents and grandparents, and one of the most popular ways to save is with a 529 college savings plan.

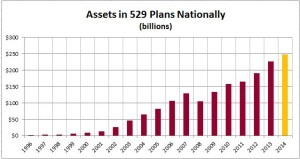

According to the College Savings Plan Network’s Annual 529 Report, 529 plans are experiencing record growth. There were 12.1 million 529 accounts by the end of 2014, up 4.1 percent from 2013. In Maryland, about 30 percent of families with children have 529 plans.

Investments by American families in 529 plans reached a record level of $247.9 billion in 2014. Total assets increased by 9.1 percent from 2013 to 2014, and investment gains accounted for 5.3 percent of the increase. Families rely on these returns to pay for ever-increasing college costs so careful consideration should go into selecting how these accounts are invested.

What is a 529 savings plan?

The 529 savings plans encourage college savings, since the growth of the contributions is free from federal income tax if used for qualified education expenses such as tuition, room and board, books, etc.

All 50 states and the District of Columbia offer 529 plans. While you are not restricted to investing in the one offered by your state of residence, there are advantages if you choose your state’s plan, such as potentially writing off a portion of your contributions on your state tax return.

You can learn more about the best ways to save for college on the Glassman Wealth Services website.

Investing in a 529 savings plan

The 529 plans work like an investment account where the dollars deposited and invested. The value of the account is subject to the markets and the growth or decline of the investments that are selected.

Most 529 plans include a variety of investment choices, including age-based options that invest in a mix of stocks, bonds, money market and other funds. They start out with more aggressive investments and become more conservative as your child nears the date they will attend college. These plans are similar to target-date funds you find in 401ks and other retirement accounts. One of the nice features about both target date and age-based accounts is that they automatically rebalance the investments. This is great for those who want to set-it-and-forget-it.

The significant difference between the two is the amount allocated to more aggressive investments as they approach their target date. Let’s compare the target date fund of someone retiring this year with an age-based fund for someone entering college in the fall of 2015. The T. Rowe Price 2015 target date retirement fund has 55 percent of its assets in stocks compared to 22 percent in the Maryland 2015 age-based 529 plan. Why the difference? Retirees continue to need the growth from stocks to sustain a much longer period of retirement, whereas college-bound kids need more of a guarantee that the funds will be there to pay for their next four years.

Investment allocations also vary state-by-state. Maryland’s 529 plan has 22 percent in stocks by college time, but Virginia has zero. If you plan to use the age-based option, make sure you are comfortable with the level of risk as your child approaches college age.

Preparing your 529 for college

Even 22 percent allocated to stocks may be too risky since college students spend those dollars in just a four-year period. They don’t have the luxury of time to wait for the market to rebound should we have another market downturn. The market crash of 2008 was not that long ago and 529 plans were not immune. The average 529 investment option lost nearly 24 percent, according to the Wall Street Journal. Think of it as losing a year of college tuition. Keep this in mind when deciding which plan to use and look at the investment allocation year-by-year to decide if you’re comfortable with the level of risk.

Fees are another thing to watch out for as they can add up and diminish returns. Some investments charge up-front commissions while others have high internal fees. SavingforCollege.org is a great resource for everything about college savings plans including the expenses of the underlying assets in each plan.

If you prefer to do-it-yourself and select investments from those offered by your 529 plan, then it’s important to remember to rebalance the account as these plans don’t offer an automatic rebalancing option.

When your child is young, I recommend allocating the account with more aggressive investments for growth. As they get closer to needing those funds for college, you’ll want to adjust the investments to be more conservative.

Starting in January 2015, those invested in 529 plans will be able to implement two investment exchanges in each calendar year rather than one. This gives the individual greater comfort that they are able to make changes to their investments if they want to, according to Joan Marshall, executive director of The College Savings Plans of Maryland.

As you countdown the years to college, pay attention to the risk and return of your 529 plan and make adjustments accordingly. You may not be ready to send them off to college when that day arrives, but your college savings plan will be.