Anyone who lives in Virginia knows it’s the only state in the region to charge an annual property tax on vehicles.

The recent spike in used car prices, based on pandemic-related low supply and high demand, has threatened to hurt Virginia taxpayers, even if they’re not in the market for a new set of wheels.

Some Northern Virginians could get relief.

Virginia’s personal property tax on vehicles, commonly known as the car tax, is calculated by each locality. In Arlington County, the 2021 tax rate for most vehicles was 5%, so the owner would pay approximately $500 for a vehicle valued at $10,000. Fairfax County’s rate was $4.57 per $100 of assessed value, and Loudoun County’s was $4.20.

Last month, Virginia Gov. Glenn Youngkin signed a law that allows each localities to choose whether it wants — or can afford to — cut car tax rates, since used car values are so high.

HB1239 gives jurisdictions that latitude, since the state constitutionally mandates 100% fair market value in property tax assessments.

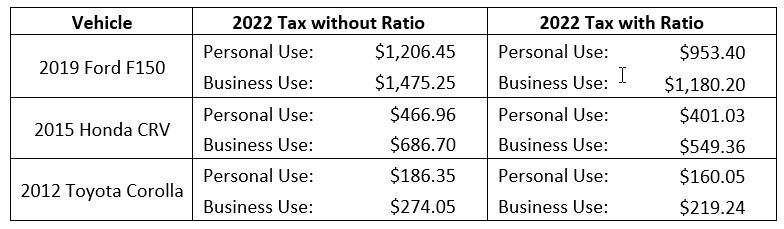

Loudoun County became the first local jurisdiction to offer the relief: The Board of Supervisors approved a recommendation, to charge tax on only 80% of a vehicle’s value.

This week, Loudoun County taxpayers should begin receiving vehicle tax bills for the first half of 2022 from the Treasurer’s Office.

Other jurisdictions are exploring car tax relief. In its budget discussions, the city of Alexandria, is weighing a proposal to assess only 77% of the Fair Market Value, while not taxing vehicles assessed at $5,000 or less.

Fairfax County’s Board of Supervisors has been considering a proposal to tax at a ratio of 85% — which could move forward in its proposed budget later this month.