Search

Showing 5596-5610 of 12946 for "taxes " Metro may see service cuts without new funding

How women can build their own economic power

Metro may see service cuts without new funding

How women can build their own economic power

5 smart ways to use your holiday bonus

Home Depot Inc (HD) and T-Mobile US (TMUS) Announce Massive Buybacks

5 Employee Benefits Trends to Watch in 2018

How to Shop for Health Insurance With an Eye Toward Mental Health

A Complete Guide to Investing in Donor-Advised Funds

Year-End Contributions Can Pay Off

Your Guide to Taking Out a Business Loan

Why the GOP Tax Plan Won't Hurt the Stock Rally

How Rising Interest Rates Will Hurt the Stock Market

Should You Pay Off Your Mortgage Before Retirement?

5 smart ways to use your holiday bonus

Home Depot Inc (HD) and T-Mobile US (TMUS) Announce Massive Buybacks

5 Employee Benefits Trends to Watch in 2018

How to Shop for Health Insurance With an Eye Toward Mental Health

A Complete Guide to Investing in Donor-Advised Funds

Year-End Contributions Can Pay Off

Your Guide to Taking Out a Business Loan

Why the GOP Tax Plan Won't Hurt the Stock Rally

How Rising Interest Rates Will Hurt the Stock Market

Should You Pay Off Your Mortgage Before Retirement?

'Shocked': Montgomery Co. scrambles to cut budget amid revenue shortfall

'Shocked': Montgomery Co. scrambles to cut budget amid revenue shortfall

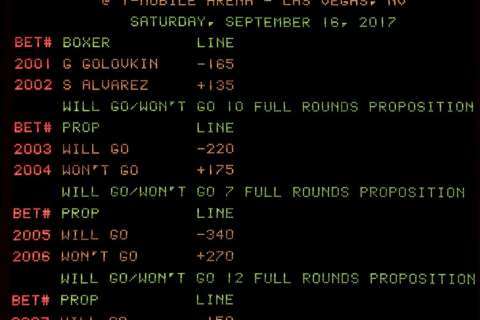

How Supreme Court���s decision on sports gambling could have seismic implications

How to Donate Your Required Minimum Distribution to Charity

How Supreme Court���s decision on sports gambling could have seismic implications

How to Donate Your Required Minimum Distribution to Charity