Federal student loan payments will resume in just two months after more than three years of zero-interest forbearance. But reentering student loan repayment will be a significant financial shift for borrowers — and most of them don’t even know basic details of repayment, like their payment amount or due date, according to a July 2023 survey from U.S. News.

Between July 17 and 26, U.S. News ran a nationwide survey of 1,202 former college students with outstanding federal student loan debt. We asked respondents a series of questions to find out how the end of forbearance will impact their finances. Here’s what we found:

— Nearly half of borrowers (46%) aren’t financially prepared to resume federal student loan payments in October. This sentiment is the highest among borrowers who didn’t obtain a degree, with 69% of them saying they’re not ready for repayment. On the other hand, just 35% of those with a master’s degree or higher said the same.

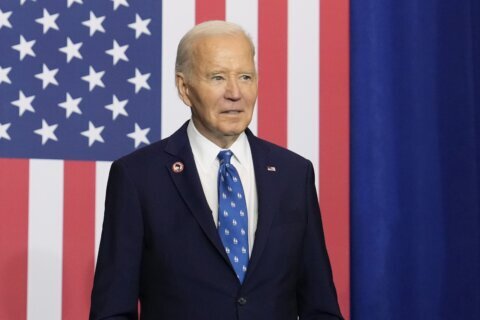

— Three-quarters (74%) had been planning on using President Joe Biden’s student loan forgiveness plan. Even more (79%) say the Biden administration should try again to forgive federal student loan debt. About 37% of borrowers have a student loan balance of $20,000 or less, which means they may have qualified to have all of their debt forgiven.

— Student loan borrowers haven’t been sufficiently informed on repayment details. Less than a third (30%) know when payments are set to resume, and 48% don’t know how much their payments will be when the bill becomes due. And while 67% have heard of the Biden administration’s temporary 12-month onramp to repayment program, only 31% know what it is.

— The vast majority of borrowers (85%) think they’ll face financial hardship due to student loan repayment. About half (49%) say they’ll have a hard time paying other bills, 43% will have to postpone other financial goals and 36% won’t be able to contribute toward their savings.

— Most borrowers (78%) plan on applying for deferment or forbearance once student loan payments resume. Additionally, 83% plan on using strategies to reduce their monthly payments, such as enrolling in an income-driven repayment plan (34%) or an extended repayment plan (23%).

— The student loan payment pause gave borrowers an opportunity to improve their finances. During forbearance, 79% of borrowers were able to use the money they would’ve used toward student loan payments to meet other financial goals, such as paying down other debts (40%), growing their savings (37%) and increasing their investments (28%).

— One in four borrowers (26%) said they were able to pay down their student loans faster during forbearance, since interest rates were set to 0%. Three-quarters of borrowers had been making payments toward their student loans during forbearance, at least occasionally.

[READ Best Student Loan Refinance Lenders]

From a Borrower’s Perspective, Student Loan Repayment Is Shrouded in Mystery

Federal student loans have been in forbearance since March 2020 — since that time, payments have been paused and interest has been set to 0%. For many borrowers, particularly recent graduates, COVID-19 forbearance has become the norm. In fact, 36% of survey respondents have had their federal student loans for less than three years, which means they’ve never been required to make payments.

But transitioning millions of borrowers into repayment has been a complicated task for student loan servicers and Education Department officials alike. Despite persistent messaging from the Biden administration, there’s still widespread confusion about when exactly payments will resume and how much they’ll cost.

Just 30% of respondents knew that their student loan payments would begin again in October; 26% said they simply didn’t know, while 27% thought payments resume in September and 17% believed they start in January 2024. To further complicate matters, only 52% of borrowers know how much their monthly payments will be when forbearance ends.

With so much uncertainty looming over their finances, most student loan borrowers are experiencing some level of stress about repayment. The vast majority (88%) are at least “somewhat” stressed about student loan payments resuming in October, with 42% being “very” or “extremely” stressed. Those without a degree experience the most anxiety: About 27% report extreme stress over repaying their student loans, compared with the 18% of degree holders who feel the same.

Repayment Is Approaching — But Nearly Half of Borrowers Aren’t Ready

Given how many borrowers are fuzzy on the details of student loan repayment, it makes sense why some feel unequipped for the end of forbearance. Slightly more than half (54%) of respondents feel financially prepared to start making payments again in October, while the rest (46%) aren’t ready.

Borrowers with advanced degrees feel more financially prepared for repayment. Two-thirds (66%) of respondents with a master’s degree or higher are ready for repayment, compared with just 31% of those who didn’t graduate or obtain a degree.

Additionally, 74% of borrowers had been counting on Biden’s student loan forgiveness plan to reduce or eliminate their debt, which could further explain why so many feel unprepared for payments to resume in October. Student debt forgiveness was struck down by the Supreme Court on June 30, giving borrowers three short months to get ready for repayment.

In the wake of the Supreme Court ruling, the Biden administration unveiled a temporary 12-month onramp to repayment program to help ease borrowers back into making monthly payments. This measure removes the threat of delinquency or default for borrowers who miss payments within the first year of payments resuming. When asked about this program, 67% of borrowers said they have heard of it — but only 31% know what it is.

With so many respondents likely to benefit from student loan forgiveness, it’s clear that Biden’s original plan was popular among them. About four in five respondents (79%) think the Biden administration should try again to forgive student loan debt.

[Read: 15 Companies That Help Pay Off Student Loans]

As Forbearance Expires, Borrowers Seek Additional Hardship Relief

For the first time in three years, millions of student loan borrowers will be saddled with an additional monthly payment. In some cases, this extra bill could upend an otherwise balanced budget.

An overwhelming majority (85%) of borrowers believe they’ll face financial hardship when federal student loan payments resume. Nearly half (49%) say they’ll have a hard time paying other bills at that time, and 43% will have to postpone other financial goals like saving for retirement or buying a home. About a third (36%) won’t be able to contribute toward their savings as a result of student loan repayment.

On top of that, many respondents are contending with rising consumer prices that are outpacing wage growth. While 40% of borrowers say their income has risen compared with March 2020 when forbearance started, 64% say their bills and expenses are higher.

Thankfully, most federal student loans are eligible for programs that allow borrowers to temporarily skip or postpone payments, providing a lifeline during times of financial hardship. Borrowers in our survey are eager to take advantage of these federal protections: 78% plan on applying for some type of deferment or forbearance when payments resume, with the most popular option being economic hardship deferment (28%).

In addition to the short-term strategy of deferring payments, most borrowers are looking for a longer-term fix. About 83% plan on using one of the following methods to reduce their monthly payments:

— Enrolling in an income-driven repayment, or IDR, plan (34%). The Biden administration recently announced changes that will cut payments in half for most IDR plan borrowers and make it easier to qualify for forgiveness down the line.

— Switching to an extended repayment plan (23%). Choosing an extended repayment plan can lower a borrower’s monthly payments, but it also means they’ll be stuck in debt for longer and they’ll pay more toward total interest costs.

— Consolidating into a single federal student loan (17%). With a federal direct consolidation loan, borrowers benefit from having a single interest rate and monthly payment, although usually with a longer repayment term.

— Refinancing their federal student loans into a private student loan (10%). By refinancing to a private student loan with a lower rate, borrowers save money — but they risk losing access to federal protections like deferment and forgiveness programs.

[Read: Best Private Student Loans.]

Student Loan Borrowers Used Forbearance for Financial Betterment

After three years of suspended student loan payments, borrowers are approaching the end of forbearance in a much better place financially than where they started. Americans put the money they saved to good use, whether their end goal was to buy a home or simply to balance their budget. All told, 79% of borrowers were able to use the money they would’ve put toward student loan payments toward meeting other financial goals. Here’s what they accomplished:

— 40% paid down other debts, like credit cards or auto loans.

— 37% increased their savings.

— 28% increased their investments.

— 26% paid down their student loans faster at zero interest.

— 24% saved up to buy a home.

— 21% contributed more toward retirement.

Additionally, 2% of respondents took the opportunity to write in their own responses highlighting their financial wins during forbearance. One common thread is that borrowers put the money they would’ve used for their student loan payments toward bettering their own financial well-being. Another shared theme is selflessness, exhibited by the few outstanding respondents who used their forbearance savings to take care of loved ones. You can see some of their answers in the interactive graphic below.

More from U.S. News

Parent PLUS Student Loan Forgiveness

Private Student Loan Forgiveness Options

7 Strategies to Get Out of Student Loan Debt

Survey: Student Loan Borrowers Brace for Financial Uncertainty in Repayment originally appeared on usnews.com