Part-time jobs with health benefits are valuable.

Medical coverage is a valuable workplace benefit, with the average cost of an employer-sponsored family health insurance plan reaching $22,463 in 2022, according to the nonprofit Kaiser Family Foundation. Although many employers limit their coverage to full-time employees, some extend plans to part-time workers as well.

“The major reason would be to attract and retain resources, particularly as employees move around with the ‘great reshuffling,'” says Kim Buckey, vice president of client services for Optavise, which provides employers with workplace benefits services. “Part-time employees may be able to fill gaps left when full-time employees leave and may provide the employer with more flexibility.”

The following 13 companies offer health insurance to part-time employees.

Starbucks

At this national coffee chain, hourly employees are eligible for benefits, including health insurance, once they work 240 hours during a consecutive three-month period. That averages out to approximately 20 hours per week. Starbucks begins coverage on the second month after workers hit that milestone. Baristas, café attendants and other hourly employees maintain their eligibility by working at least 520 hours in a six-month period.

“This has turned into a major way that they can attract and retain employees,” says Walter Sabrin, senior vice president of recruiting services at Vensure Employer Services, a professional employer organization, or PEO, that offers human resources solutions. While not every company will want to incur the expense of offering health insurance to part-time workers, Sabrin notes PEOs can simplify the process for those who do.

UPS

Unionized workers at UPS may be eligible for health insurance so long as they work at least 225 hours during a three-month period. The company’s workers, such as delivery truck drivers and package handlers, receive coverage through TeamstersCare. Benefits cover medical care, behavioral health services, prescription drugs, dental care and more.

JPMorgan Chase

JPMorgan Chase hires a significant number of part-time associate bankers to staff its branches across the country. So long as these employees are regularly scheduled for at least 20 hours a week, they are eligible for health insurance coverage. Workers need to be employed for at least 60 days before beginning their benefits, which include prescription drug, vision and dental coverage.

Activision Blizzard

Software developers, digital artists and marketing managers can all find job opportunities at Activision Blizzard. The company is a leading developer of interactive entertainment, including games such as Call of Duty and World of Warcraft. Workers don’t need to put in 40 hours a week to get benefits there. Any part-time U.S. employee who is regularly scheduled at least 30 hours a week is eligible for health benefits.

American Red Cross

At the American Red Cross, part-time workers who are on the job at least 20 hours a week are eligible for health benefits. New hires must enroll for medical insurance within 31 days of their hire and can select from four different plans that come with varying levels of coverage and costs. Phlebotomists, medical technologists and bus drivers are among the positions currently open at the organization.

Costco

Warehouse club Costco is a popular store for shopping in bulk and can be a good place to work if you’re looking for a part-time job that comes with health insurance. Once cashiers and other part-time hourly employees have 60 days of continuous service, they can enroll in one of several health insurance plans offered by the company. Except in Hawaii, seasonal, temporary or limited part-time employees are not eligible.

Aquent

Even temporary workers can get health benefits if they find a part-time job through Aquent, a staffing company for the marketing and creative industries. The company provides health insurance to workers on assignment for less than one year so long as they are working 20 hours a week. Workers have their choice of three plans, and Aquent subsidizes premiums for each hour worked.

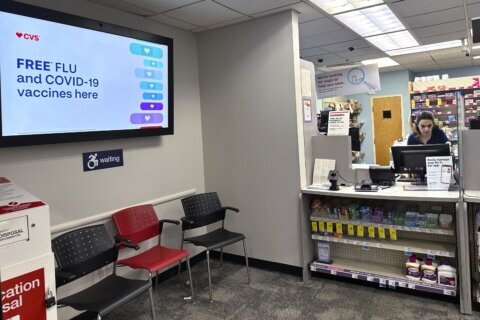

Aetna CVS Health

CVS Health, which acquired insurer Aetna in 2018, offers medical and prescription coverage to all employees who work at least 30 hours a week. Benefits include free preventive care and annual CVS Health contributions for health savings account-eligible plans. Those who work 12-29 hours a week are eligible for a fixed indemnity plan which provides cash benefits for doctor visits, prescriptions and other health care.

Staples

Both full-time and part-time employees are eligible for health coverage at Staples. The office supply retailer has locations across the country and needs retail salespeople, warehouse workers and van drivers to work on a part-time basis. These employees can also participate in the company’s 401(k) plan and sign up for other insurance products such as dental, vision and life.

San Mateo County, California

This California county is only one example of a local government that provides health insurance to part-time employees. In San Mateo County, regular and probationary employees who work 20 hours or more per week can enroll in a health plan that will cover them, their spouse and children under 26 years of age. Local governments have diverse needs and may hire employees ranging from janitors to nurses on a part-time basis.

Pindel Global Precision

This Wisconsin-based manufacturer is one of the firms taking a new approach to providing health insurance coverage to part-time workers. Rather than providing a plan directly, Pindel Global Precision uses individual coverage health reimbursement arrangements, or ICHRAs, to help employees pay premiums for insurance purchased on the government’s health insurance marketplace or through Medicare.

“With an ICHRA, an employer can contribute a flat fee toward an employee’s health care, which the employee can then use to purchase insurance,” explains William Sweetnam, technical and legislative director for the Employers Council on Flexible Compensation, an organization that advocates for tax-advantaged benefit programs. “The employee must purchase a health care plan with the funds, and any remaining money can be used for qualified medical expenses.”

Meijer

Midwest grocer Meijer offers medical coverage to its part-time workers after they have completed 60 days of service. Those who work 30 or more hours per week can enroll in a high-deductible plan that comes with a health savings account. Employees who clock in fewer hours per week can enroll in coverage that comes with a health reimbursement account. Hourly positions at the retailer include cashiers, department associates and pharmacy technicians.

Lowe’s

Part-time employees at home improvement store Lowe’s can enroll in a medical plan that offers limited benefits. Coverage includes up to four primary doctor office visits and four specialist office visits per calendar year. However, hospital and surgical coverage is not included. Cashiers, stockers and customer service representatives are among the part-time positions available at Lowe’s.

These 13 companies offer health insurance to part-time workers:

— Starbucks.

— UPS.

— JPMorgan Chase.

— Activision Blizzard.

— American Red Cross.

— Costco. Aquent.

— Aetna CVS Health.

— Staples.

— San Mateo County, California.

— Pindel Global Precision.

— Meijer.

— Lowe’s.

More from U.S. News

19 Part-Time Retirement Jobs That Pay Well

7 Best Part-Time, Work-From-Home Jobs

The Best Jobs You’ve Never Heard Of

13 Companies Offering Health Insurance to Part-Time Workers originally appeared on usnews.com

Update 03/02/23: This story was previously published at an earlier date and has been updated with new information.