ANNAPOLIS, Md. (AP) — Maryland lawmakers gave final passage on Friday to the state’s $63 billion budget legislation, which includes tax and fee increases to help pay for transportation and education, though not as much as some lawmakers wanted.

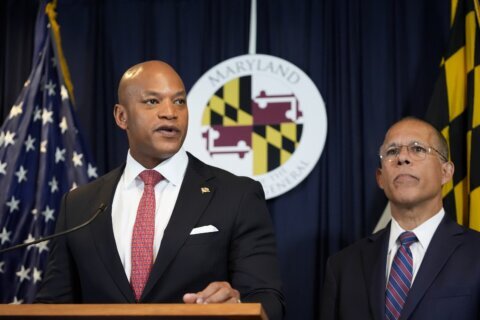

The General Assembly, which is controlled by Democrats, mostly kept intact Gov. Wes Moore’s $63 billion proposal for the budget year starting July 1. Moore, a Democrat, submitted a balanced budget plan in January without tax increases.

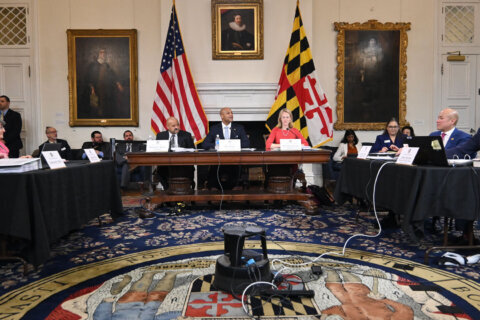

The House and Senate voted for the budget bill Friday, as well as a companion reconciliation measure that is working in tandem to balance the budget.

After negotiations between the House and Senate, lawmakers added some transportation-related fees that will raise about $252 million during the budget year. As part of the package, a new statewide fee of 75 cents per trip will apply to ride-hailing services.

Vehicle registration fees also will rise, and a $23 surcharge will help pay for rising costs of the state’s emergency trauma system. In addition, there will be a $62.50 surcharge on zero-emission electric vehicles to help make up for gas tax revenues that their owners don’t pay, and there will be a $50 surcharge on plug-in electric vehicles.

A variety of tobacco tax increases, including an additional $1.25 on a pack of cigarettes, will help generate about $91 million for K-12 education, though that is estimated to drop off due to a projected decline in tobacco use.

The revenues are focused on paying for transportation and the state’s K-12 education funding plan known as the Blueprint for Maryland’s Future, which phases in larger amounts of money to expand early childhood education, increase teachers’ salaries, and provide aid to struggling schools.

“We know that those things cost, and we do have to raise some revenues now and then to cover those costs, but I think we did it in an efficient way and a responsible way,” Democratic Sen. Guy Guzzone, the Senate’s budget chairman, told reporters Friday. He noted additional money for education, as well as for road projects, local highways and transits.

House and Senate differences on how much to raise new revenues held up passage of the state’s spending plan until late in the legislative session, which is set to adjourn Monday at midnight.

Last month, after the Senate passed its budget legislation, the House proposed a $1.3 billion plan to get further in front of expected education costs and transportation funding shortfalls. In addition to taxes, fees and tolls, it included corporate tax reform and a proposal to legalize internet gambling.

During negotiations, the Senate largely held firm, rejecting legislation to raise tolls, the corporate tax reform proposal known as combined reporting, and internet gambling. But the House kept pushing and managed to add some new revenues.

“We were able to thread the needle,” said Del. Ben Barnes, a Democrat who chairs the House Appropriations Committee.

The revenue debate played out in an election year for an open U.S. Senate seat and congressional races, featuring the surprise U.S. Senate candidacy of former Republican Gov. Larry Hogan, who campaigned against tax increases to win his first term in 2014 in the heavily Democratic state and won reelection in 2018.

Copyright © 2024 The Associated Press. All rights reserved. This material may not be published, broadcast, written or redistributed.