Leasing demand for data centers in Northern Virginia remains as strong as ever, but developers may be running out of room for new projects closer in.

CBRE’s report on data center activity for the first half of 2023 notes developers are migrating to new sites within Virginia. Data center activity remains highest in Loudoun and Prince William counties, but CBRE said growth is emerging in Fauquier, Culpeper, Stafford and Spotsylvania counties due to limited availability of development sites closer to D.C.

“With limited available supply in the Northern Virginia core, more end-users are evaluating peripheral submarket viability, which is driving inquiries to new locations,” said CBRE Senior Vice President Jamie Jelinek.

“Ultimately the emergence of a new submarket will depend on end-user commitments. The tightening vacancy rates in Loudoun and Prince William counties have also accelerated rental rate growth in those submarkets.”

In the first half of 2023, the Northern Virginia data center market set a record low-vacancy rate of just 0.94%.

Leasing activity in the first half of the year totaled 192.8 megawatts absorbed in Northern Virginia, where power is currently available or expected to soon be.

CBRE said despite supply chain delays, Dominion Energy is making progress upgrading its transmission and distribution network.

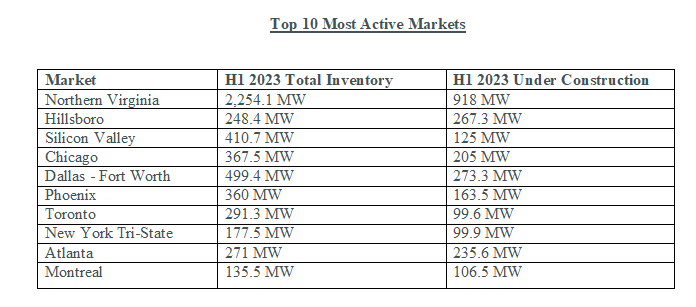

Data center projects currently under construction in Northern Virginia total 918 megawatts.

Across North America, CBRE reports 2,254.1 megawatts of data center supply is under construction. That is an all-time high, and 70% of data center space under construction is pre-leased. Average asking rents for data center space is up 15.9% from a year ago.

Check out CBRE’s full North America Data Center Trends report online.

Below are the 10 most-active data center markets in the first half of 2023, according to CBRE’s report.