Financial planners say the general rule is that households should not spend more than one-third of income on housing costs — and homeowners in Maryland and Virginia appear to be staying below that threshold.

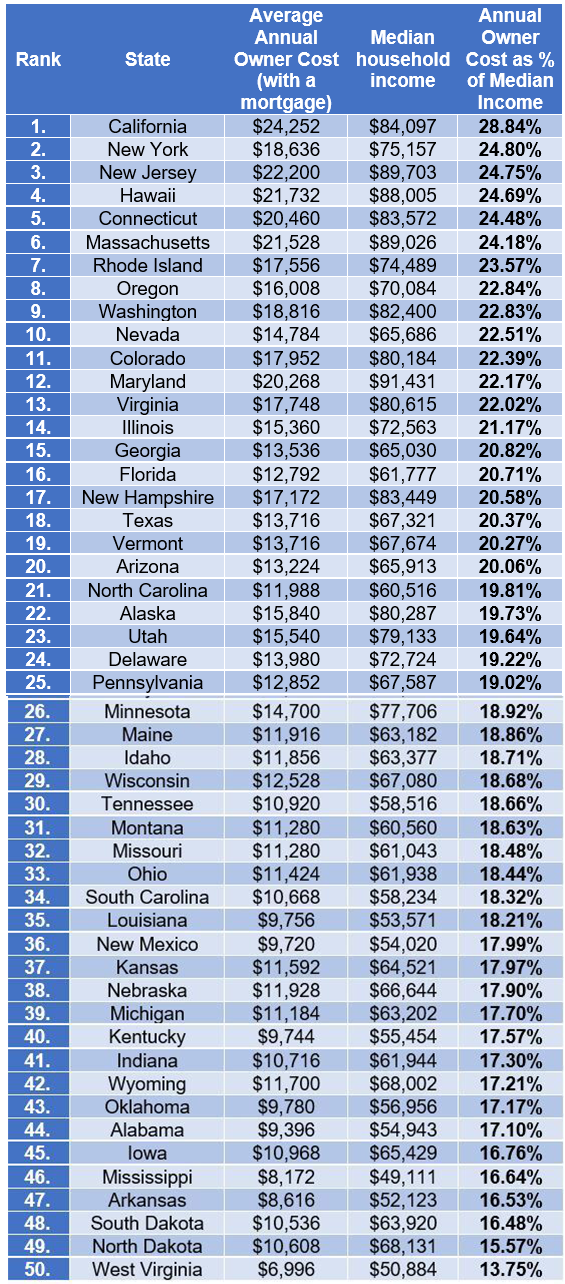

Census Bureau data, analyzed by a Re/Max agent team in New Jersey, ranks states for homeowner expenses based on median incomes and average annual costs to determine annual owner costs as a percentage of median income. For its report, housing costs include mortgage payments, insurance, property taxes, utility bills and condo or homeowners’ association fees.

Among the 50 states, Maryland has the highest median household income, at $91,431, but also among the highest annual homeowner costs, at an average of $20,268. That means Maryland homeowners have an annual housing cost of 22.17% of median income, ranking Maryland 12th highest.

Virginia ranks No. 13, with average annual housing costs of $17,748 and median household income of $80,615, for an annual owner cost as a percentage of median income of 22.02%.

The analysis does not include data for D.C.

California tops the list for homeowner costs as a percentage of median income, at 28.84%. West Virginia ranks as most affordable, at 13.75%.

Below is estimated homeownership costs for all 50 states, based on the Census Bureau’s 2021 American Community Survey, courtesy of New Jersey Real Estate Network.