The office vacancy rate in the District is now a record high 18.9%, but a small share of office buildings account for a substantial portion of empty office space.

Commercial real estate firm JLL reports 41% of the office vacancy rate in D.C. is concentrated in just 60 buildings, and overwhelmingly older buildings. Office buildings constructed before 2000 account for 75% of the city’s vacancy, and that is more than double a decade ago.

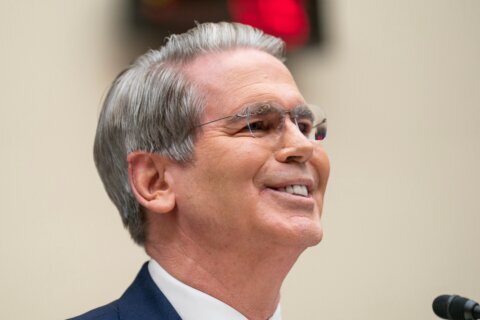

“The pandemic has created a bifurcation in the office market of ‘haves and have-nots’ now, so if you’re an owner of an older building, you are facing challenges as tenants flock to new or recently renovated space that offer more in the way of amenities and more of a commute-worthy experience for those employees. As a result, owners of older buildings are left with real critical investment decisions today,” said Michael Hartnett, Mid-Atlantic Research Lead at JLL.

The District and developers are actively pursuing office-to-residential conversions of older buildings, and JLL has identified 8.5 million square feet of existing office stock as residential redevelopment targets. That’s 10% of older buildings in downtown D.C., and 4.6 million square feet of those properties are already in various stages of conversion.

But not all older D.C. buildings are good candidates for apartment or condo conversion.

“Many of the older vacant buildings in downtown D.C. are mid-block with deep floor plates, and both of those really limit the amount of natural light needed for an apartment. And mechanical upgrades, plumbing, reconfigurations, those also pose challenges,” Hartnett said.

Those newer or recently renovated, amenity-rich buildings in D.C. are not facing vacancy challenges. JLL said 23% of D.C.’s office buildings have zero vacancy, and many more have negligible vacancy rates. A good share of them are fully occupied by just one tenant.

“Government entities occupy many of the fully occupied buildings in D.C., as do many nonprofits and associations, because many of those buildings are single-tenanted. Twenty percent of these buildings are concentrated in NoMa and Southwest, driven by the large number of single-occupant users like the federal government,” Hartnett said.

Being a Class A or trophy building is not the only ticket to a low vacancy rate, with 119 of the buildings with zero vacancy being Class B or Class C buildings, JLL said.