Economists and real estate industry leaders generally agree that the U.S. housing market has slowed and will continue to in 2023, but have tended to use words like “temper,” “modest” and “correction” when referring to declining sales and prices ahead.

“Crash” is a word that has been almost universally avoided.

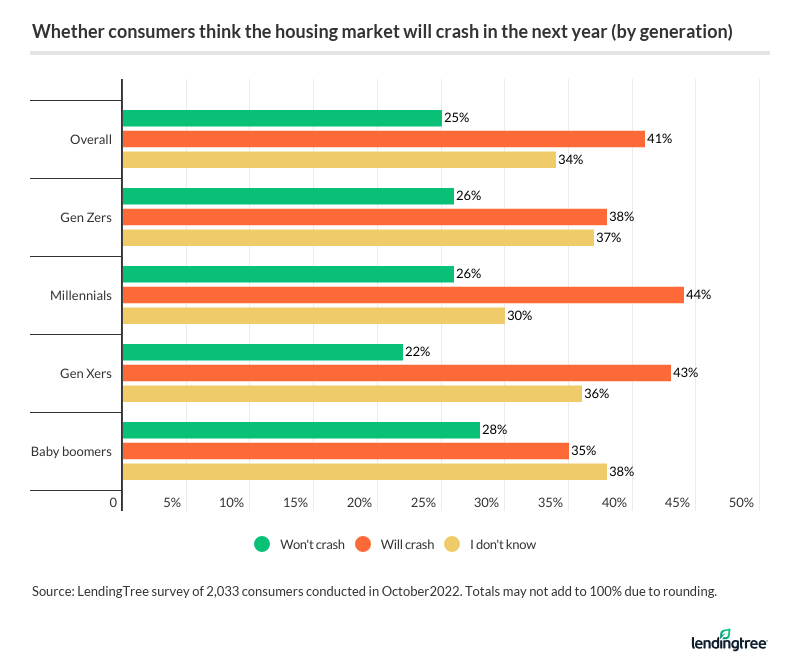

Consumers may have gloomier expectations.

A recent LendingTree survey of 2,033 Americans, aged 18 to 76, found 41% believe the housing market will crash in the next 12 months. The survey was conducted Oct. 18. Crash is defined as a significant drop in home values in a short period of time.

Millennials were the most likely generation to agree, at 44%, while baby boomers were the least likely, at 35%.

Of those expecting a crash, three out of four think it will be as bad or worse than the 2008 housing market crash.

Are those opinions an overreaction?

“I agree that the word crash is probably a little too scary sounding, and a little severe sounding. The reality is that home prices will probably come down,” said Jacob Channel, senior economist at LendingTree.

“With all that said, I know it sounds like doom and gloom. But the truth of the matter is that the housing market was so hot in 2020 and 2021, any return to normal is going to seem like a really big decline,” Channel said.

Even with a double digit decline in home prices in the year ahead, home values would still be up by double digits compared to 2019, before the pandemic.

Home prices posted the third straight monthly decline in September, according to the S&P/Case Shiller Home Price Index, falling an average of 1.2% month-over-month in the 20 largest metros. The monthly decline in the D.C. metro was 1.5%.

Existing home sales fell for the ninth consecutive month in October, according to the National Association of Realtors.