The Federal Housing Finance Agency has set conforming loan limits for mortgages that can be bought by Fannie Mae and Freddie Mac for 2021, and the limits have been increased for the fifth consecutive year.

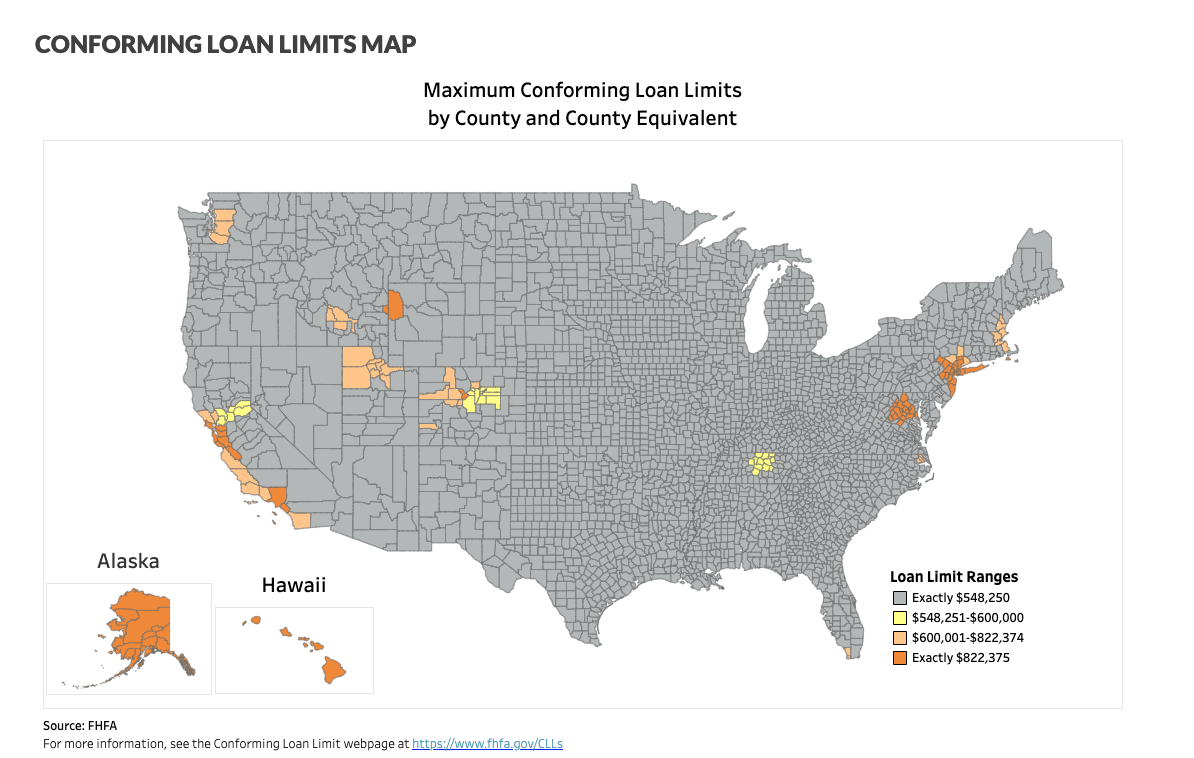

The conforming loan limit for one-unit properties in 2021 will be $548,250, an increase from $510,400 in 2020.

For higher cost areas, including the District and surrounding counties, the limit will be $822,375 next year, up from $765,600 this year.

FHFA sets conforming loan limits based on national house price increases, which rose 7.42% between the third quarters of 2019 and 2020. The increase in loan limits matches the increase in home prices.

High-cost areas are those in which 115% of the local median home value exceeds the baseline conforming loan limit. The high-cost area conforming limit is capped at no more than 150% of the baseline loan limit.

Maximum conforming loan limits do not apply to every county or county equivalent in the country, but FHFA says it will apply to all but 18 counties in 2021.

The $822,375 conforming loan limit in the Washington area applies to every county and county equivalent in both Northern Virginia and suburban Maryland.

Below is a map showing counties nationwide by 2021 conforming loan limits from FHFA: