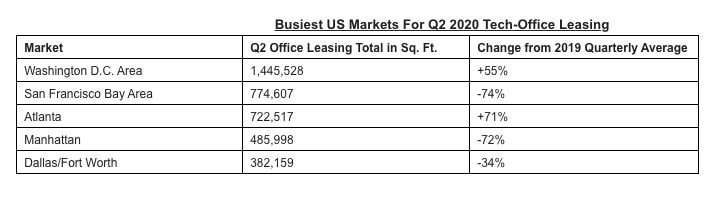

The pandemic took a toll on tech office space leasing nationwide last quarter, falling by 46% compared to a year ago, but the D.C. area was one of the only standouts, with area technology companies taking more office space in the second quarter, and the market led the nation for new tech leasing activity by total square feet.

CBRE reports 1.456 million square feet in office space was leased by area tech firms, up 55% from leasing activity in the same quarter a year ago.

D.C.-area tech leasing expanded, even as it contracted sharply in other tech hubs. Leasing was down 74% in the San Francisco area, down 72% in Manhattan and down 34% in Dallas/Fort Worth.

By comparison, tech companies in San Francisco added about 775,000 square feet of office space, half the amount in the Washington area.

“The D.C. area continues to be an attractive market for technology companies. As the second-ranked tech talent market in the U.S., with a highly educated workforce, large concentration of millennials, and significant tech job creation, the D.C. area’s tech-office leasing sector is well positioned to capitalize on the next growth cycle and thrive as the pandemic subsides,” said Meredith LaPier, vice chair at CBRE.

Northern Virginia led tech office leasing in the second quarter, at 1.1 million square feet, or 76% of the second quarter total.

Tech office leasing has accounted for 44% of total office leasing in the D.C. region through the first half of this year, compared to 29% during the first half of 2019.

Nationwide, total office space leased by tech companies in the second quarter was 6.8 million square feet, down 46% from the second quarter 2019.

In addition to the D.C.-area market, San Diego was the only other market with a gain in tech office leasing, accounting for 366,000 sure feet, up 58% from a year earlier.

Below is a chart of select markets second quarter comparisons on tech office space leasing, courtesy CBRE: